The Quest for Regulation of Uncollateralized Digital Lending in Ethiopia

Keywords:

Uncollateralized digital lending, Micro Small and Medium-sized Enterprises, Digital Credit ProvidersAbstract

The availability and accessibility of credit is instrumental to startups that are in need

of ‘seed money’ to raise investment capital. The availability of a credit system that is

easy to secure is very critical. The current digital revolution has changed the

traditional hurdles for accessing loan. Nowadays, technology has changed the

modality and conditionality of accessing loan. Ethiopian banks and non-bank

economic sectors, like Ethio-Telecom have started offering uncollateralized digital

lending. The Ethio-Telecom, took the first initiative in offering easy and

uncollateralized digital credit system in Ethiopia. However, the regulatory landscape

is not ready to effectively to govern the increasing uncollateralized digital lending.

This short article attempts to highlight the need for setting a regulatory framework

that specifically suits to uncollateralized digital lending in Ethiopia by applying

doctrinal research methodology.

Downloads

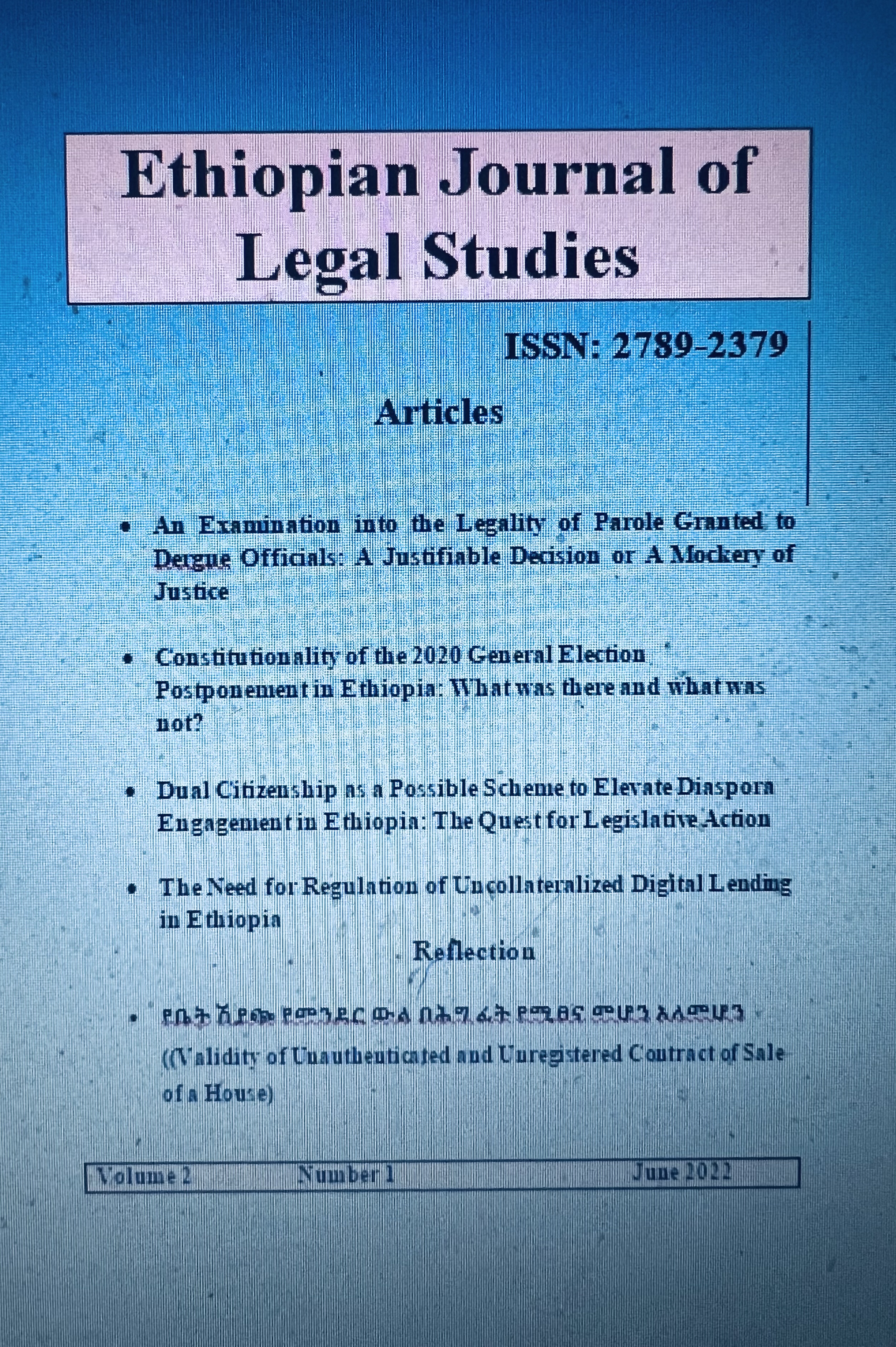

Published

Issue

Section

License

Copyright (c) 2022 School of Law, Ethiopian Civil Service University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.